Aexbridge Capital is a privately held investment firm, specializes in direct lending, credit and equity solutions across our strategies and unique special situations.

Aexbridge Capital is a privately held alternative investment firm. The firm specializes in direct lending, asset backed debt, equity, hybrid solutions and other unique special situations for real estate owners, primarily in western Europe.

Aexbridge has 5 offices throughout Europe, we provide local on-ground experience and expertise in each market we invest.

We seek out attractive investment opportunities providing flexible capital solutions to the real estate industry with capital preservation as our top priority. Moreover, special servicing teams are fully integrated and have significant experience investing through multiple credit cycles and across different asset classes.

Aexbridge excels in sourcing, analyzing transaction complexity, deal structuring, underwriting and asset management of its investments.

Aexbridge’s founders, have a proven track record over more than twenty years of successful investing experience in different cycles in debt and equity.

Alberto López

FOUNDER / CEO

CEO of Aexbridge Capital and Co-founder of Urbania International, a real estate private equity firm with over €1 billion under management. Mr. Lopez has been involved in over €2 billion of opportunistic, value add and debt real estate investing in Europe and LATAM and across different asset classes. Mr. Lopez received an International MBA from EM Lyon & EOI and has a Bachelor’s degree of Economics.

Tomás Gasset

FOUNDER / BOARD MEMBER

Board member of Aexbridge Capital. He began his professional career at Arthur Andersen. In 2000 he founded a real estate development company, Grupo Suite and later together with Mr. Lopez founded Urbania. He has completed projects in Spain, Brazil, Mexico, Morocco and Peru totalling over €2 billion. Tomas is Economist with an MBA in financial management from the Ramon Llull University of Barcelona.

Pablo Díaz

PRINCIPAL

Responsible for loan origination and execution at Aexbridge Capital. Pablo has over 10 years of experience in the real estate industry having completed over €250m in direct acquisitions and €300m in loans across Spain and Portugal. Prior to this, Pablo was part of the KPMG Corporate Finance team in Madrid advising in NPL/REO transactions as well as M&A deals. Pablo holds a double BA in both Law and Economics from Universidad Carlos III de Madrid (Spain).

Javier Beperet, CFA

PRINCIPAL

Responsible for loan origination and execution at Aexbridge Capital. He has over 10 years of experience in the real estate and infrastructure industry. Javier has completed over €200m loans between Spainand Portugal. Prior to this, Javier was part of Arcano Asset Management team and PwC transactions department in Madrid, structuring transactions in different sectors and asset classes.

Javier holds a double BA in both Law and Economics from Universidad Pública de Navarra (Spain). Javier is also CFA Charterholder, having passed the three levels of exam in 2015, 2016 and 2017.

Miguel Monar

PRINCIPAL

Responsible for loan origination and execution at Aexbridge Capital. He has over 10 years of experience in real estate and finance, including a strong track record in M&A and strategic advisory for Private Equity funds across Spain and London. His expertise spans the underwriting and execution of investments in real estate, non-performing loans (NPLs), infrastructure, and TMT sectors. Prior to this, Miguel was Vice President at BlueCarbon, and also worked for TSSP (Sixth Street Partners) and Hudson Advisors (Lone Star Funds). Miguel holds a Bachelor’s in Business Administration and an MSc in International Finance from CUNEF.

César Vázquez

CHIEF LEGAL OFFICER

Cesar acts as a legal counsel at Aexbridge Capital. With over 19 years of experience in Corporate, Real Estate and Financial legal matters. He has led and executed transactions lending and acquisition transactions of real estate assets and real estate companies totaling more than €3 billion. B.Comm Int. Bus. Concordia Uni, LL.B Civil law, Ottawa Uni, BPP law school. Admitted to Bars of Spain, UK, Canada.

Rafael Cruz, CFA

INVESTMENT ASSOCIATE

With over 5 years of experience in capital markets and alternative investments working across firms such as Aedas Homes, Intermoney, PwC and BNP Paribas.

Julio Alcántara

DIRECTOR

25 years of experience in the real estate industry managing real estate projects for private and institutional investors. More than 250 residential, alternative, and hospitality projects built in Spain and Portugal. Graduate in Business Administration and post graduated in Urban Planning and Real Estate Management from Universidad Pontificia de Comillas (Spain).

Inés Vera

HEAD OF OPERATIONS

Head of Operations team at Aexbridge Capital. Ines has more than 7 years of experience in financial analysis across different industries. Prior to this, Ines was part of Deloitte Spain audit team where she gained experience on accounting and management. She holds a double BA in both Economics and Business Administration from Universidad de Málaga (Spain).

Robert Mangin

INVESTMENT MANAGER GERMANY

As managing partner of EARLYREAL Real Estate Ventures and Aexbridge Germany, Robert has extensive experience in the real estate industry, with a focus on financing structuring and investment strategies. In his former role as Investment Manager at BNS Real Estate Capital, he has overseen numerous project structurings and real estate transactions across German-speaking markets. Robert holds a Bachelor’s degree in Business Administration from RWTH Aachen University (Germany).

Leonard Harms

INVESTMENT MANAGER GERMANY

Leonard holds a Master of Laws (M.Iur.) from the WWU Muenster University (Germany), with a specialization in Regulatory Law. Following his studies, he worked as a loan broker for one of Germany’s largest crowd investing firms, where he successfully structured and financed several project developments in Germany. As an Investment Manager, he conducted corporate restructurings contributing significantly to the strategic and financial optimization.

Tatjana Schetle

INVESTMENT MANAGER GERMANY

Tatjana holds a Bachelor’s degree in Urban Planning and has over ten years of professional experience as an Investment Manager at BNS and MOUNT, both since their founding. In these roles, she managed numerous projects and structured complex financing solutions. Her responsibilities also included developing strategic partnerships and overseeing corporate investments.

BOREALIS

2018

| LOCATION: | Madrid, Spain. |

| ASSET TYPE: | Residential development |

| STRATEGY: | Bridge loan to acquire an existing hotel and reconvert into 74 condo residences. |

CAVA BAJA

2019

| LOCATION: | Madrid, Spain. |

| ASSET TYPE: | Residential portfolio |

| STRATEGY: | Co-investment with a local developer for a distress acquisition of 4 residential buildings. Preferred equity structure. |

CB

2019

| LOCATION: | Madrid, Spain. |

| ASSET TYPE: | Corporate loan |

| STRATEGY: | Bridge loan to provide working capital of an industrial company secured by hard assets. |

AUSTRALIS

2019

| LOCATION: | Madrid, Spain. |

| ASSET TYPE: | Residential development |

| STRATEGY: | Bridge loan to support the acquisition of a plot of land to develop a luxury condo tower with 208 units. |

FLEX

2019

| LOCATION: | Madrid / Barcelona / Malaga, Spain. |

| ASSET TYPE: | Corporate Transaction. |

| STRATEGY: | Start-up capital to help an operational company set up and grow it’s coworking business. The capital is structured as a preferred equity. The seed capital targeted the opening of 5 facilities in Madrid, Barcelona and Malaga. In addition, it has been agreed a credit line to cover operational expenses and new openings. |

INTERHOUSING

2019

| LOCATION: | Madrid / Valencia / Malaga , Spain. |

| ASSET TYPE: | PBSA |

| STRATEGY: | Mezzanine facility to cover CAPEX in a portfolio of 4 student housing projects. |

THUNDER

2019

| LOCATION: | Madrid, Spain. |

| ASSET TYPE: | BTR portfolio |

| STRATEGY: | Whole loan to fund the acquisition of 14 residential and tertiary buildings in Madrid. |

NEMBUS

2020

| LOCATION: | Madrid, Spain. |

| ASSET TYPE: | Residential development |

| STRATEGY: | Preferred equity scheme to acquire and develop a luxury community of 10 villas in the North of Madrid. |

FIVE STARS

2020

| LOCATION: | Madrid, Spain. |

| ASSET TYPE: | Residential development |

| STRATEGY: | Bridge loan to support the acquisition of a plot of land to develop a luxury condo tower with 84units. |

AS

2021

| LOCATION: | Spain |

| ASSET TYPE: | Corporate Transaction |

| STRATEGY: | Mezzanine loan to support the acquisition of a large RE company in Spain with a portfolio of over 700.000 sqm of land. |

PHOENICIAN

2021

| LOCATION: | Málaga, Spain. |

| ASSET TYPE: | Hostels and Touristic Apartments. |

| STRATEGY: | Construction loan facility for six buildings in the historical city centre. The company own and operate a cutting edge stay & share experiences for short term tourists and long term visitors. |

OLITE

2021

| LOCATION: | Pamplona, Spain. |

| ASSET TYPE: | Residential and commercial. |

| STRATEGY: | Bridge loan for the acquisition of a plot of land in one of the most consolidated neighborhoods of Pamplona with 65.000 sqm of residential buildable area and 16.500 sqm of commercial use. |

CEIBOS

2022

| LOCATION: | Marbella, Spain. |

| ASSET TYPE: | Residential. |

| STRATEGY: | Aexx has structured a whole loan for a luxury development in Costa del Sol. The loan finance part of the plot acquisition and CAPEX. The Sponsor is a renowned developer. |

PINECOVE

2022

| LOCATION: | Spain |

| ASSET TYPE: | Hotels. |

| STRATEGY: | Corporate Loan to back a large Spanish Hotel Group providing s/t liquidity to fund its operational needs. |

ALBA

2022

| LOCATION: | Barcelona, Spain. |

| ASSET TYPE: | PBSA. |

| STRATEGY: | Whole loan for the acquisition of a 14,500 sqm of buildable area plot to develop 516 single en-suite unit purpose-built-student-housing (‘PBSA’). |

BEACON

2023

| LOCATION: | A Coruña, Spain. |

| ASSET TYPE: | Retail park development. |

| STRATEGY: | Whole loan facility for a 8,600 sqm retail park development in Santiago de Compostela fully pre-let to tier 1 tenants. |

BEACH

2023

| LOCATION: | Catalonia, Spain. |

| ASSET TYPE: | Hotel. |

| STRATEGY: | Senior secured loan for the acquisition of a 5* beachfront hotel with 90 keys and c.12,000 sqm GLA. |

NEVADA

2023

| LOCATION: | Spain and Portugal. |

| ASSET TYPE: | Office, industrial and residential. |

| STRATEGY: | Dividend recap credit facility to a Pan-European Real Estate Company. |

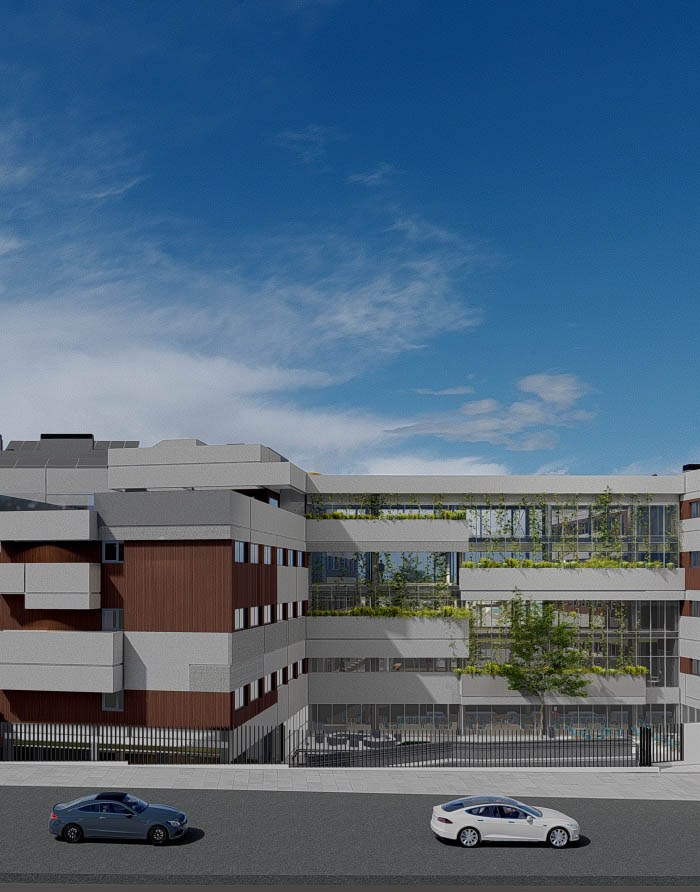

GECKO

2025

| LOCATION: | Balearic Islands, Spain. |

| ASSET TYPE: | Logistics. |

| STRATEGY: | Senior secured facility to fund the acquisition and infrastructure works of a site with full planning consent for a 200,000 sqm state-of-the-art logistic park in the Balearic Islands. |

PLAYA

2025

| LOCATION: | Andalusia, Spain. |

| ASSET TYPE: | Hotel. |

| STRATEGY: | Senior secured loan to refinance a diversified hotel portfolio across touristic destinantions of Andalusia. |

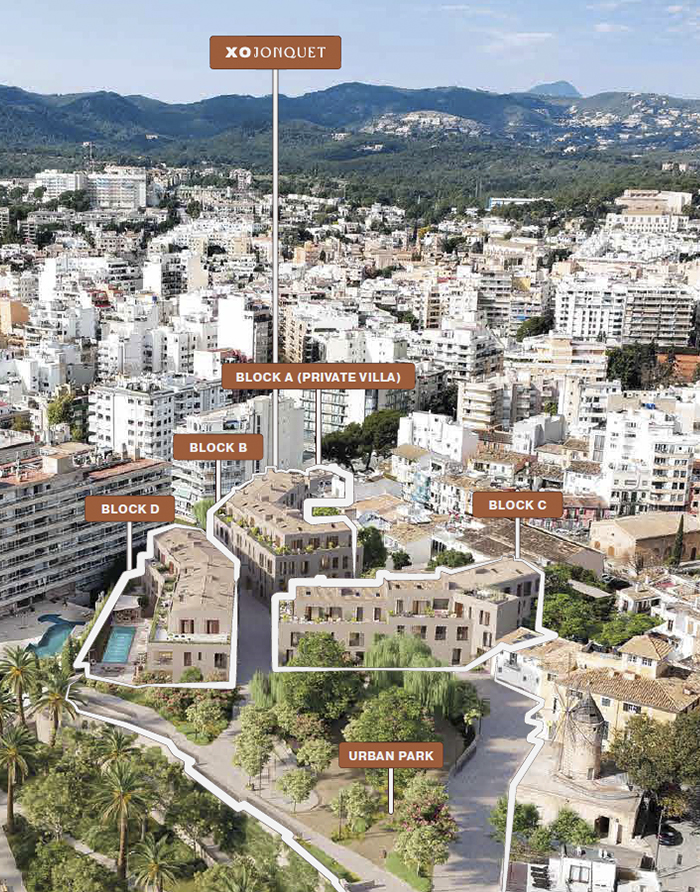

VALMAR

2025

| LOCATION: | Palma de Mallorca, Spain. |

| ASSET TYPE: | Residential. |

| STRATEGY: | Senior secured financing facility to refinance the existing bridge loan and finance the Capex of a residential development comprising 85 luxury apartments, with a buildable area of 11,800 sqm, located in Palma de Mallorca. |

MAR I TERRA

2025

| LOCATION: | Palma de Mallorca, Spain. |

| ASSET TYPE: | Residential. |

| STRATEGY: | Senior secured financing facility to refinance the existing bridge loan and finance the Capex of a residential development with a buildable area of 9,500 sqm.It will deliver 57 exclusive residences featuring panoramic views of Palma’s bay and port, expansive interiors, and contemporary architecture. |

Aexbridge’s real estate lending team focuses on a differentiated direct-origination strategy in core Western Europe. The team typically favours the less crowded market of deals between €10-€75M.

Downside protection is provided through secured debt position, with a value-add angle created from the rapid origination and structuring of the deal to the hands-on asset management to advance any issues in order to take pre-emptive actions while offering solutions for repayment.

Aexbridge Capital originates, structures and invests in real estate backed transactions. We focus on companies and assets with solid market fundamentals, proven management teams and robust financial histories.

Our focus is on providing a wide range of funding such as bridge loans, mezzanine financing, whole loans, senior positions that exhibit strong returns relative to their risk of loss. Most of our activity in this strategy is self-originated through our extensive local origination networks.

Aexbridge Capital invests in special opportunities across an array of asset classes and market niches. We focus on providing capital in situations in which credit may be scarce, seeking control-oriented debt and equity investments in assets or sector experiencing distress or some form of temporary dislocation.

These situations may include corporate stress or distress, where we provide rescue facilities or restructuring capital backed by real estate assets or investing in out-of-favor or countercyclical assets in market dislocation environment, we also purchase attractively priced loans in the secondary market, particularly during times of market disruption. The strategy combines expertise in both credit and private equity investing by targeting investments with significant upside potential, buying assets below market price and improving both operations and capital structure.

Aexbridge Partners has transitioned from a background in equity investing to a focus on credit—while retaining the equity mindset that informs our approach. This dual perspective gives us a unique ability to understand and address equity needs intuitively, through a collaborative and disciplined process. We actively seek opportunities that combine fixed-income structures with equity participation, partnering with experienced and reputable sponsors. Our strategy emphasizes value creation by contributing at a strategic level—leveraging both our expertise and that of our local partners to drive outcomes that often exceed initial expectations.